Article

Africa, the leader in mobile banking

We study the reasons why the African continent is at the top of mobile banking rankings

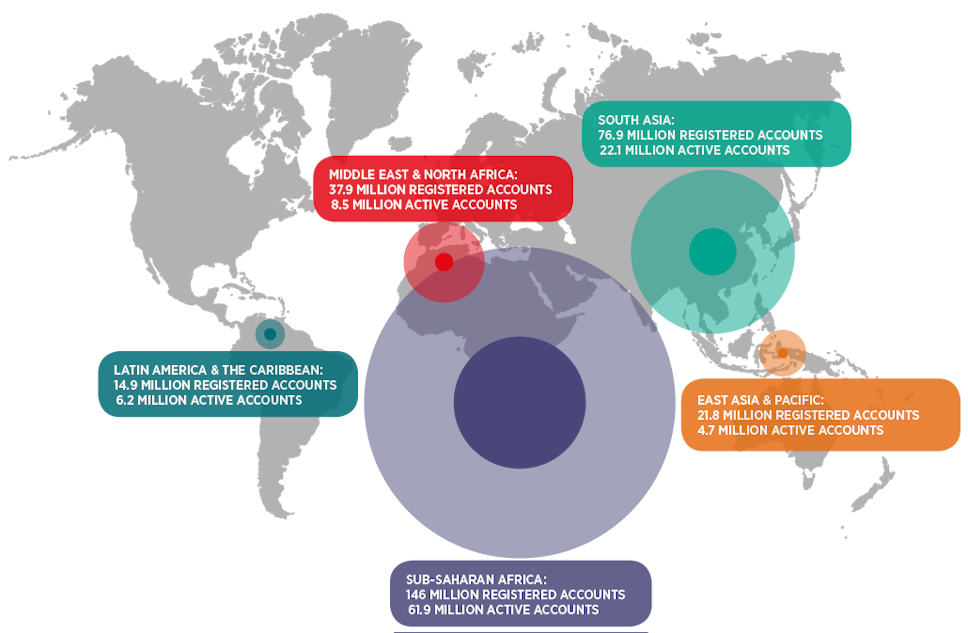

Upon analyzing the map of mobile payment methods in the world, it may surprise people unfamiliar with the matter to see that its use is concentrated in regions with low levels of development, such as Africa. It is difficult to find exact figures because the Mobile for Development study (prepared by the GSMA) distinguishes between Sub-Saharan Africa on the one hand and the Middle East and North Africa on the other. However, broadly speaking, it can be said that in the beginning of 2015, the continent had approximately 165 million registered mobile banking users (55% of the worldwide total) and 66 million active accounts (representing 64% of the total). In terms of providers, 261 have been identified throughout the world, of which more than half operate in Sub-Saharan Africa.

What is this leadership position due to? It is because of the limited degree of development in these regions, especially Sub-Saharan Africa. In this part of the world, a very high number of citizens have a cell phone, but very few have bank accounts. In the case of Kenya, 87% of the population had a cell phone in 2011, while only 21% were customers at a bank. Wider 3G coverage and higher sales of low-cost smartphones have created incredibly positive prospects for this market for the next five years.

Active mobile money accounts by region (GSMA, 2015):

Essentially, mobile banking services make it possible to deposit and withdraw money at the offices in the agent network of telecommunications providers (prepaid card resellers and points of sale that operate as bank agents) and at automated teller machines (ATMs). The services that are used the most are:

Remote mobile payments:

P2P transfers

Paying invoices

Paying salaries, pensions, and benefits (by public entities and businesses)

Refilling the balance of prepaid phone cards

The service is easy to use. The payer sends an SMS text message to the collector with the amount of the transaction and a PIN code. The recipient then visits an office or ATM, where upon verifying that the code is correct, is given the money in cash.

The leading mobile network operator (MNO) is M-Pesa (m for mobile, and pesa, which means “money” in Swahili). It is a Safaricom (a Vodafone subsidiary) service based on SMS text messages, so it is accessible from any cell phone, and it stands out because the user interface is simple and the service is easy to use. It was inaugurated in 2007, and it currently has 18.8 million users in seven countries, including Kenya, Uganda, Tanzania, Rwanda, and Afghanistan. It charges on average 1% of the amount sent. The company recently inaugurated a new mobile microsavings, microcredit, and microinsurance service called M-Kesho (“mobile future”).

Another major mobile banking operator in Kenya is MobiKash. In Nigeria, the company with the largest market share is MoneyBoxAfrica. In Zimbabwe it is Ecocash, part of Econet, whose agent network also provides service to OneWallet, part of NetOne, and the third wheel is the Telecash service, which is part of Telecel. mTopUp is present in Egypt, Libya, Tunisia, Algeria, and Morocco.

Banks are seeing how these new entities are taking a significant portion of their traditional business, and they have started to react. Western Union is negotiating with MTN to open a mobile banking service in the Ivory Coast. National Bank of Egypt, MasterCard, and Etisalat are preparing an agreement to launch a mobile transfer service that in the future should make it possible to pay invoices and also buy services and products. In Nigeria, MasterCard has opted, in collaboration with the government, for a different (and rather polemic) solution: Creating a new mandatory digital identification card that serves as an electronic wallet.

Public entities have the responsibility of participating in the ecosystem by leading the definition of a model that facilitates the efficient and secure development of these services

As explained in our “Payment Methods and Personal Identification in the Digital Age” report, mobile banking has not yet been able to implement solutions that meet the conditions of universality, security, simplicity, and reliability that users in developed nations demand.

The authors of the study have considered some of the matters that must be resolved in order to reach optimal service levels, such as whether the security for accessing user passwords and credentials will be suitable to avoid fraud and gain the trust of users.

The main challenges to be overcome are:

Interoperability: Users from different networks must be able to perform transactions directly with each other. (“At the moment, all of the businesses are walled gardens,” says Charles Niehaus, Managing Director at Circle Payments.)

Roaming: International transfers must be available for a reasonable price. (This is a small part of the service, but it showed the most growth in 2014 (65.5%), despite the fact that current prices are approximately 12% of the amount sent.)

Lastly, the report notes that public entities have the duty of participating in the ecosystem by leading the definition of a model that facilitates the efficient and secure development of these services. A regulated environment will have a significant effect on increasing the number of businesses that enter the market and of customers willing to use these new features.

The challenges faced by pioneer countries in the area of mobile payment methods are driving the development of technologies that can be taken advantage of by society as a whole. The illiteracy of many potential users in Africa and India is causing MNOs to research biometric security methods, such as voice, fingerprint, or iris recognition.

Currently, the global business of international money remittances is worth $500 billion, of which $30 billion represent mobile transfers. In other words, mobile transfers only comprise 6% of the business, but Alex Murphy, Senior Mobile Analyst at WorldRemit, believes that in the near future, “mobile money will play a fundamental role in global remittances, and this will help reduce fees and improve the speed and convenience for users.” In our report on payment methods, we revealed a telltale sign: “By 2017, the value of mobile transactions is expected to reach $721 billion.”