Article

Network footprint management as an opportunity

How can telecommunications providers gain a competitive advantage with footprint management, thereby maximizing customer satisfaction and profitability?

Fiber to the Home (FTTH) networks have become one of the most important telecommunications investments. This infrastructure makes it possible to provide service for the maximum number of potential end customers (households), referred to as the “footprint”.

To optimize the value of infrastructure investments, telecommunications providers are opting for an infrastructure sharing model, which increases the complexity of footprint management. This requires several roles that pave the way for new ownership models. In turn, these roles create a universe of layers that cause management issues, but these problems are what create the opportunities to monetize footprint management and augment this valuable asset.

Reducing costs by sharing

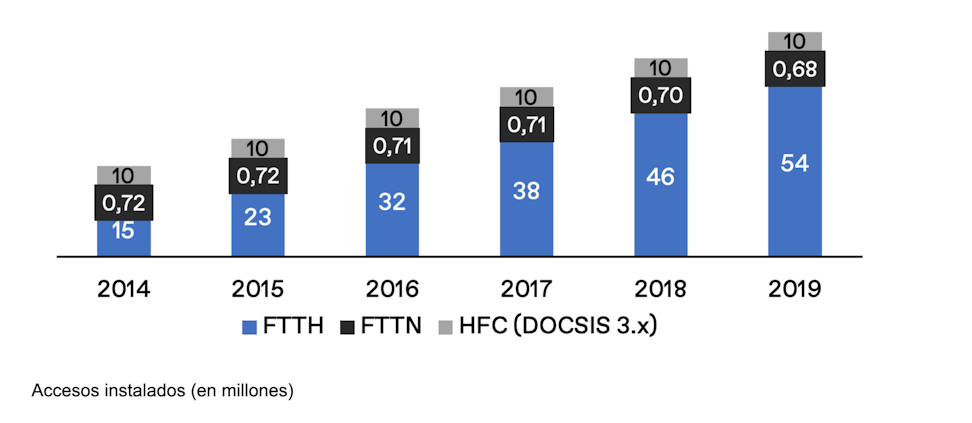

To give us an idea of the investment, at the start of 2020, there were approximately 60 million sockets or Internet access points installed in Spain, of which approximately 54 million were FTTH, resulting in an estimated investment of approximately €6 billion. At the time, this network generated €3.4 billion in revenue annually. With regard to sharing, and only considering the Telefónica sharing model, this figure already surpasses €700 million.

This is the environment in which the sharing model offers values that set us apart because it allows us to dilute capital expenditures and the costs associated with infrastructure maintenance by dividing them among participants.

In the Spanish market, a telecommunications provider can manage a marketable footprint of up to eight different footprints. Examples include the 21 million marketable footprints declared by MÁSMÓVIL and 8 million direct households; Vodafone, with 22 million and 11.2 million direct; Telefónica, which has multiple access agreements with its third-party network, has an 18% take-up rate for direct and 30% in the case of wholesale; and Onivia plans to build a network that covers 9 million households.

Regulations that allow telecommunications providers to share networks have reached a significant level of maturity for shared infrastructures, transmissions, and local or regional access points. However, the complexity of marketable household footprints lies in signing agreements between telecommunications providers.

New roles for managing the footprint

These agreements between telecommunications providers lead to the roles mentioned earlier, and these actors ensure compliance with the formal agreements and targets (SLA and SLO). The most important roles that can be played by the same company are defined as follows:

Retailer: Provides service to end customers and interacts directly with them (sales, billing, support, etc.).

Wholesaler: Wholesaler telecommunications providers offer network services to retailers. There are different types of service (local, bitstream, guaranteed) with different relationship models.

Maintainer: Maintains some of the footprints marketed by the wholesaler. Performs maintenance and operations tasks, and is responsible for resolving incidents that arise.

Builder: The network’s original builder frequently does work that requires physical intervention on the footprint.

The traditional model based on building a proprietary network and connecting customers is obsolete. There are multiple examples of ownership and financing models, such as Onivia, Adamo and Lyntia. These agreements are strategically critical, just as the co-investment agreements between MÁSMÓVIL and Orange, and the Telefónica agreements for sharing its infrastructure and network.

Customer satisfaction and profitability, the new focus

However, there are also drawbacks to the new sharing models. This complex footprint structure could make it possible for customers to be in the wrong or less optimal footprints. Approximately 30% of a telecommunications provider’s customers are in an incorrect footprint.

To give us an idea, this could have an impact of approximately €23.7 million for every million customers of a telecommunications provider.

These agreements are dynamic, and as a result of subsequent agreements, a telecommunications provider could leave a portion of its customers in an “incorrect” and costlier footprint. This is estimated to occur with approximately 15% of a telecommunications provider’s customers, so these customers should be managed properly to migrate them to the most suitable footprint, even if it is costly. This is necessary because these customers are usually more difficult to retain and they affect network capacity, and they are potentially dissatisfied customers.

A practical example of how leading telecommunications providers use these concepts can be found in the success story involving MásMóvil and Nae Link.

Shifting from the model of building and selling with what has been built, to managing and monetizing the footprint, has become a pressing matter. The most optimal focus should be centered on customer satisfaction and profitability based on three key levers:

Business: The aim is to ensure customers are assigned to the optimal footprint by analyzing our footprints, third-party agreements and business plans, and focusing on necessary migrations.

Operations: We seek to guarantee the correct and optimal execution of the processes involved in managing the footprint, such as optimizing the activation, correctly defining the processes for assigning the right footprints, providing assurance by managing incidents properly, handling footprint occupancy, planning and executing removals from the footprint and migrations, as well as other services (transmission, redundancy, etc.).

Information systems: Automating the solutions adopted, advanced analyses and alliances.

This approach should be based on a solid information structure with a suitable level of logical abstraction that allows a high and low degree of analysis for decision-making. Without going too much into detail, we could establish three levels for this structure:

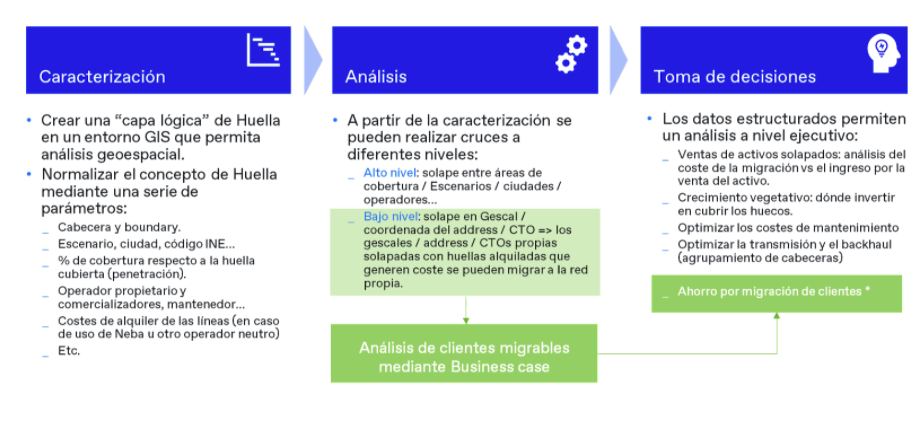

Characterization: We implement a logical layer in a GIS (geographic information system) setting and we standardize the footprint (INE codes, penetration, coverage percentage of the footprint, lease costs, etc.).

High-level (overlapping footprints, cities, telecommunications providers) and low-level characterization analysis (GESCAL codes, addresses, network access points overlapping with leased boxes, etc.).

Decision-making: We can use the data analyzed to adopt the necessary stance within the sale of overlapping assets, investments to fill identified gaps, optimized maintenance costs and backhaul (grouped headers).

In summary, for footprint management to help build a competitive advantage, quick action is required using a comprehensive model that guarantees success and maximizes customer satisfaction and profitability.