Article

The impact of digitalization on the insurance industry

Operations efficiency, improved customer experience, and data management are the major opportunities for insurance companies

The insurance industry is familiar with the new social reality that is taking place. The clients, policyholders, and employees of entities are becoming increasingly digital and, above all, they are more and better informed. Adapting to the situation and meeting new customer expectations, based on digital interactions, the demand for new services and products, and an improved experience, are probably the biggest industry challenges.

The digital transformation must be based on defining a strategy and the roadmap, and then ensuring the effective execution of the digital initiatives that improve and adapt key aspects of entities’ value chains.

These initiatives must take their surroundings into consideration, but above all, they must adapt to an organization’s degree of digital maturity and the business model defined by the types of clients, distribution channels, products/services sold, internal processes, organizational structure, culture, history, and individual brand features.

Some of the main value propositions that position the companies that implement them in a beneficial situation are:

Improved multi-channel customer relationships and new distribution models

More than 50% of customers consult online channels, insurance company websites, comparison platforms, and social media before purchasing an insurance policy. With the onset of digitalization, entities with traditional customer relationships based on agents and brokers, or direct channels such as call centers, are focusing on digital channels, especially those that use mobile devices, social media, or the expansion of new online features, to provide comprehensive solutions for multi-channel customers.

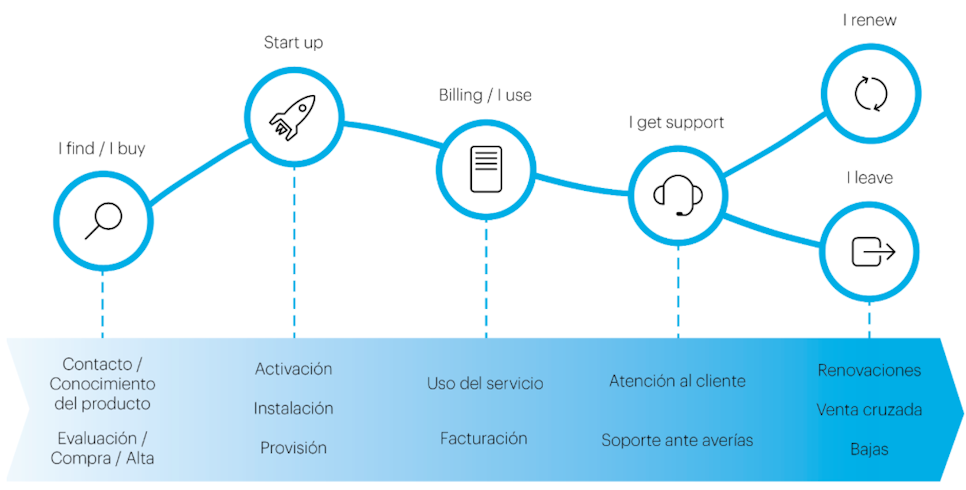

However, the challenge lies in creating an integrated customer experience at all the points of contact with the company (customer journey) by making the necessary adjustments to processes, products, and services, as well as by managing the change in a gradual manner.

This improved customer experience affects three key business aspects:

More contracts

Resistance to changing providers

Becoming an opinion leader for the product and the existing provider

Internal operating efficiency

The new expectations of digital customers—immediate responses, new consumer habits, and changing schedules—result in the need to create infrastructures, processes, and efficient internal capacities that are able to quickly address customer needs.

To implement these changes, entities must understand how their customers interact with the company through the customer journey and the impact on back-office processes in order to optimize the organizational and operational structure, lower costs, and offer personalized yet profitable products.

Advanced data management

Compared to traditional data analysis systems that use sociodemographic criteria, the mass processing and advanced analysis of data will allow companies to develop new products and services that are personalized and profitable, and also focused on knowledge of the customer.

The ability to design an offering in a flexible manner that takes into consideration the real needs, preferences, and lifestyles of customers will allow insurance companies to strategically position themselves to face client requests via the multiple ways of contacting the entity, thereby improving the customer experience and the impact on the business.