Article

Mobility forecasts for 2020

We analyze mobile industry trends for the next five years

Ericsson has presented its cell phone usage forecasts for the next five years in its “Mobility Report 2015”. This is a key period due to the quickly growing number of users, the penetration of smartphones and high-speed technologies, and the appearance of new uses (the Internet of things).

These are some of the key results that will help us understand the direction of this changing industry:

By 2016, the number of smartphoneusers is expected to match the number of basic phone users, and then double by 2020. This is due to greater accessibility in developing markets, such as the Asia Pacific region, the Middle East, and Africa.

By 2020, 90% of the world’s population over the age of six will have a cell phone (9.2 billion users), and 70% (6.1 billion users) will use smartphones (this number is currently at 2.6 billion).

5G will be commercially available in 2020, and subscription uptake is expected to be faster than for 4G. This growth will be driven by new use cases, especially in the area of communication between machines.

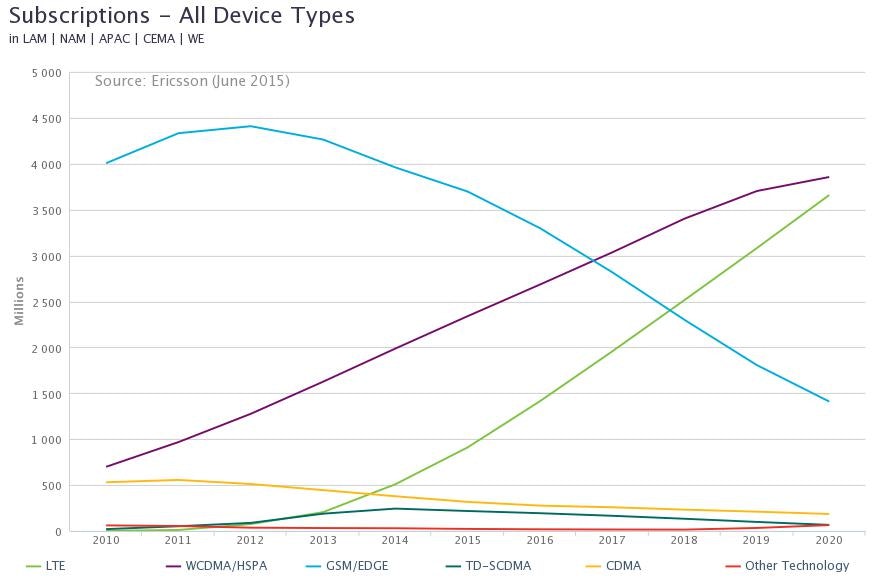

By the end of 2020, 80% of users will have access to mobile broadband, and there will be 3.7 billion LTE users, although WCDMA (3G) will make up the largest share:

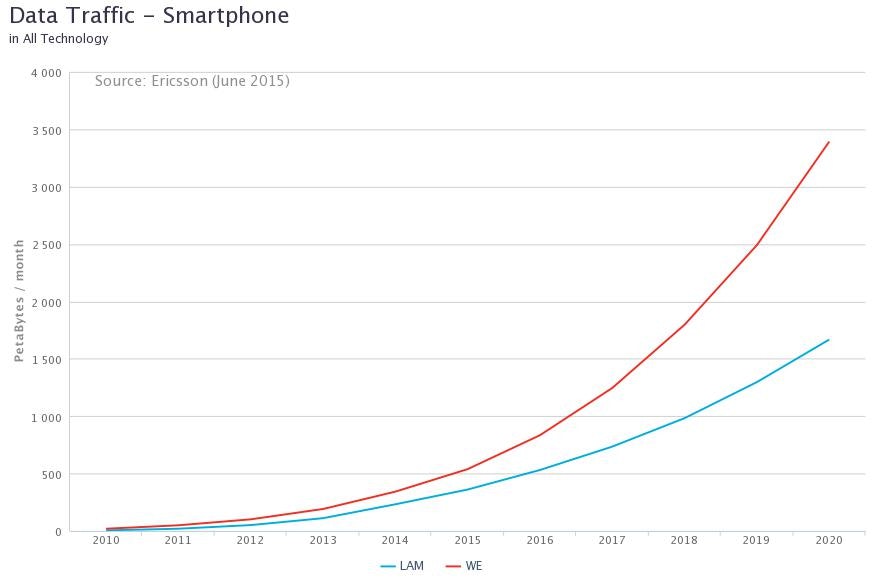

The growth in the number of smartphone users will be 140 million in Western Europe (WE) and 330 million in Latin America:

However, data usage will be higher in Europe:

On a global level, data usage will multiply by ten and 80% of mobile data traffic will be from smartphones. In addition, 60% of all mobile data traffic will be from video due to new streaming consumption habits.

The prospects described by Ericsson, which are more realistic than in the past, along with similar trends in fixed infrastructures, show a tremendous potential for society as a whole and for the telecommunications industry in particular. However, they also present a relatively new challenge:

The increased complexity in deploying and overlapping different networks, including the materialization of 2G calls as a basic voice service.

Maintaining customer experience quality and adjusting to higher expectations.

Defining a value model that adapts investments to revenues.

Society and regulators are faced with the challenge of guaranteeing that these opportunities will transform into increased productivity and competitiveness, and into tools for improving social welfare and reducing inequality and poverty. This also occurs in the context of a market that is essentially deregulated and with a primarily decreasing number of players following recent mergers and acquisitions between telecommunications providers.

It is essential to implement an ambitious yet realistic strategy, effective and professional management that is based on experience and is not afraid of change, and operations focused on customers and efficiency.