Article

The status of the 2G/3G network sunset

The arrival of 5G will eliminate 2G and 3G networks, freeing the spectrum they occupy for other uses

Currently, the mobile telecommunications sector is solely focused on the upcoming roll-outs of 5G, the IoT (Internet of Things) and MEC (Multi-access Edge Computing), all of which will undoubtedly mark a turning point within the mobile segment.

However, the resulting elimination of 2G and 3G networks is not a topic of discussion.

Up until now, new generations of smartphones have coexisted with past technologies (only the first analog generation has disappeared), but the arrival of 5G will eliminate 2G and 3G networks, freeing the spectrum they occupy for other uses. Although certain features enable spectrum sharing between technologies, we must accept that 2G/3G networks will ultimately be shut down.

The aim of this article is to evaluate the challenges involved in turning off these mobile networks, and our view on how services should be dismantled and migrated for service providers, companies and organizations.

Introduction. Mobile generations

2G

Second-generation cellular technology, 2G, also known as GSM (Global System for Mobile Communications), was the first digital generation and the first global cellular communications network to set a common standard by ETSI (European Telecommunications Standards Institute) that was adopted in nearly every country.

The main features of this generation are:

It was developed, primarily, to transfer voice, fax and SMS services.

It has a circuit-switched architecture for making calls.

It features time-division multiple access (TDMA).

There are separate bands for sending and receiving, using 200 KHz carriers.

This was the first network that allowed international roaming.

As time passed, and primarily due to the emergence of the Internet, mobile networks were equipped with higher data transmission capacity via GPRS (General Packet Radio Service). Therefore, GPRS can be viewed as a data service for GSM users, but using packet switching and multiplexing techniques. The maximum transfer speed that can be reached via GPRS is approximately 170 Kbps, in theory.

3G

As Internet penetration sped up, and given the data transfer limitations of the 2G system, the 2000s marked the arrival of 3G, the third generation of wireless mobile telecommunications technology, by the hand of the UMTS (Universal Mobile Telecommunications Service).

The main features of this generation are:

The core of this network is based on circuit and packet switching.

It uses the CDMA (Code Division Multiple Access) technique.

Each carrier is allocated 5 MHz of bandwidth.

It can be used for voice calls and data transfers.

The data transfer rates are up to seven times faster than those of 2G.

4G

The arrival of smartphones and their app ecosystem, along with the Internet’s continuous evolution, was accompanied by a growing demand for higher data rates on mobile networks. This resulted in the creation of 4G, also known as LTE (Long Term Evolution), which currently supports most of our mobile data traffic. Its key features are:

Packet-switched network, solely with all-IP architecture.

Carriers are available with different bandwidths, ranging from 4 to 20 MHz.

Voice is introduced through IMS (IP Multimedia System).

End-to-end service quality is implemented within the network.

Techniques with multiple-input multiple-output (MIMO) antennas are used.

5G

With the next generation, the upcoming evolution will be much greater and result in improved efficiency, faster data rates and enhanced services.

This is expected to enable other vertical industries to enter and offer new solutions that up until now have been supported on proprietary networks (e.g., IoT solutions).

All digital technologies currently coexist. However, this will come to an end, and in the years to come, we will witness the elimination of 2G and 3G networks.

Factors involved in 2G and 3G networks being shut down

The decision as to which network should be turned off first (2G or 3G), and how to do so, depends on various factors that may vary according to the interests of individual telecommunications providers and geographic regions.

Some of the factors that may influence the decision are:

1. Coverage footprint: Shutting down 2G and 3G networks could result in a smaller coverage footprint, which would suddenly leave users without service and lead telecommunications providers to lose subscribers. This impact must be analyzed in detail before any decisions are made.

2. Devices/subscribers: Another factor involved is the current fleet of devices and the supported technologies.

For example, M2M (Machine to Machine) devices, such as point of sale payment terminals, rely primarily on 2G networks. Since these devices are harder to migrate to a new technology, telecommunications providers who offer these services to a significant customer portfolio are opting to maintain 2G networks in areas where an M2M service base has been rolled out.

Additionally, there are many users with mobile devices that only support 2G or 3G [mainly in countries with a poorly developed economy].

According to the latest Ericsson Mobility Report (June), the number of 2G/3G subscribers is expected to drop by close to 900 million throughout the world by 2024, for a reduction of approximately 120% compared with 2018. However, there is still a significant number of 2G/3G subscribers to date.

3. Voice service: Telecommunications providers often need to maintain traditional 2G/3G networks in order to support voice services because, in theory, 4G technology does not support this service in circuit-switched mode.

To solve this, VoLTE [Voice over LTE – 4G] technology provides a more efficient solution for voice services than 2G/3G technology. However, VoLTE is not yet available on many 4G networks [around 25-30% have not yet started or are in the initial stages of deployment], which means that 2G/3G networks must remain in place for voice services.

4. Regulatory factors: In certain instances, regulatory obligations may play a role in the maintenance or shutdown of 2G/3G networks. Every country has its own regulations for the spectrum and mobile services since a global regulatory framework does not exist.

5. Competition and available services in each country: The fact that certain telecommunications providers begin to shut down their traditional networks to make room for new technologies, and therefore new services, may indirectly force other telecommunications providers to take similar action.

The status of the global 2G/3G network sunset. Where does it begin?

A key decision is whether to first shut down the 2G or the 3G network. This decision will be closely linked to the factors stated earlier. Therefore, there is no single answer to this question, but rather as the following text will explain, there are different solutions for each region.

Europe

Everything points to the theory that 3G networks will be turned off before 2G networks. As will be stated further on, it seems that Europe will be a very unique and different case from the rest of the world.

This is primarily due to the extensive roll-out of M2M and IoT types of services, which are based on 2G technology. Additionally, Europe is considering the option of re-leveraging 2G technology and using it for services such as NB-IoT (Narrowband Internet of Things), primarily due to its low cost and vast coverage.

For example, Vodafone has announced that 3G will be turned off throughout Europe between 2020 and 2021, and Deutsche Telekom plans to do the same in 2020. However, neither of these companies, or Telefónica for that matter, have publicly stated plans to shut down 2G.

Interestingly enough, it seems that Swiss operators will be the first European providers to shut down 2G networks. Sunrise already completed the shutdown process in 2018, while Swisscom plans to do so in 2020.

Spanish telecommunications providers are evaluating the most suitable way to proceed, and although none have made their plans public, everything points to the idea that they will follow the European trend and give priority to turning off 3G networks first. In fact, Telefónica recently announced that it plans to shut down the 3G network by 2025 and that 2G will remain operational indefinitely.

Asia

In contrast to European trends, the East Asia region is currently leading the shutdown of traditional 2G networks over 3G networks.

The 2G network is no longer available in certain countries such as Japan, Macao, Singapore and South Korea, whereas in other countries, such as Taiwan and Thailand, the 2G network will be turned off in the near future.

As a specific example that goes against this trend, China Mobile is shutting down its 3G network because it is based on TD-CDMA, which does not have an international presence. On the other hand, China Unicom is turning off its 2G network first.

Oceania

This region follows the same trend as Asia, opting to prioritize eliminating 2G technology overall. Telstra, Optus and Vodafone have already shut down their 2G networks in Australia, and Vodafone is the only telecommunications provider that still offers 2G service in New Zealand.

North America

The situation here is radically different from the one in Europe and is closer to the one in Oceania and Asia. In the United States, three of the four leading telecommunications providers (ATT, Verizon and T-Mobile) have already turned off their 2G network or set a date to do so. The same applies to Canada, with Telus and Bell, which have already shut down their 2G network.

Mexico will be the last country in the region to eliminate its 2G network, although Movistar and ATT have already announced that they plan to do so in 2019.

Africa

These markets are less developed than the ones mentioned earlier, and they are not at the forefront of the 2G/3G network sunset. As a result, it is harder to predict a future scenario at this time. However, overall, it is expected that 3G will be turned off first and that 2G networks will remain in place longer.

This is due to the high number of 2G devices, the fact that 3G devices also support 2G, and that 2G can be used as CS-Fallback for 4G networks and devices without VoLTE. It also appears that GSM will continue to exist until 2030.

Central America and South America

The trend in this region remains somewhat unclear and is still being defined. Colombia is one of the countries that is currently leading the analysis of the 2G/3G sunset. Regulators are defining a roadmap for shutting down 2G or leveraging the technology to be used for the IoT or M2M.

In Brazil, on the other hand, it appears that the 2G network will be the last to be shut down due to the use of M2M applications, and 3G networks will be the first to be turned off as 4G coverage becomes available.

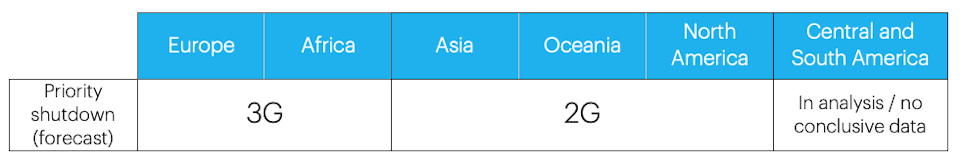

The following table summarizes the predicted priorities for shutting down 2G/3G networks by geographic region:

How to face the impending 2G/3G dismantling process

Based on our experience with telecommunications providers, manufacturers, large corporations and the government, this section explains our vision on how the dismantling process should be faced by everyone involved: telecommunications providers on the one hand, and companies and telecommunications network user administrations on the other.

Telecommunications providers

The decision to dismantle a certain technology, and the subsequent shutdown process, consists of three major phases:

Identifying scenarios and analyzing potential migration scenarios, business cases and risks for each scenario.

Some of the factors analyzed in this assessment are:

The number of devices that only support the technology or technologies to be dismantled.

Geographic distribution by area of interest.

Device revenues that support each of the technologies, including subscriber payments and additional amounts obtained from roaming.

Potential contractual and regulatory obligations.

Operations and maintenance contracts, and the remaining service life of equipment.

Traffic trends and devices linked to the technologies, for voice and data services.

Analysis of excess capacity in other technologies.

Financial analysis: cash-out, depreciation, etc.

Selecting the best scenario for the dismantling process. Based on the previous analysis, the best scenario is selected and the following items are analyzed in detail:

Savings and profits that can be obtained by dismantling: energy, operations and maintenance, spectrum reusability, equipment resales, etc.

Losses and additional costs incurred due to the shutdown: this includes analyzing aspects such as losses from a lack of roamers on the network, potential fines because of lost coverage, device discounts, etc.

Additional investment, such as the cost of dismantling the equipment, spectrum refarming, changing SIMs, etc.

Risks of the selected scenario: customers, competition, regulatory risks, etc.

Shutdown plan. Once the scenario has been selected and justified, the next step is to define the action plan to carry out the shutdown, including:

Governance model that will rule the shutdown process.

Customer migration plan.

Refarming plan to reuse the spectrum for another technology.

Uninstallation plan for the network to be dismantled: phases and regions.

Risk management plans.

Corporate and government clients on the networks

On the other hand, from the perspective of 2G/3G network customers, it is important to analyze what applications and services are supported by the 2G/3G networks that will be impacted by the shutdown and must be migrated to new technologies.

Some of the applications that are usually affected are those that provide M2M/IoT services, such as point of sale terminals, security alarms, water/electricity/gas meters, vehicle fleet management systems, factory sensors and industrial processes.

Here, once again, the decision on how to proceed consists of three major phases:

1. Identifying solutions. Analyzing the affected services that run on the 2G/3G network, and evaluating alternative solutions by considering technical and operational aspects, as well as the economic impact:

Identifying the affected services.

Preparing a detailed inventory of the affected equipment for each service.

Identifying alternatives: new devices with new technologies.

Available technologies for migrating services: 4G, 5G, Sigfox, LORA, etc.

Analyzing the coverage footprint of each technology based on the needs of every service.

Other impacts: outsourced services, operations and maintenance, system customizations, etc.

Defining potential new processes for outsourcing, operations and maintenance.

Financial analysis for the short, medium and long term.

2. Selecting the best scenario for migrating the services to a new technology. This should include:

Technical and financial justification of the selected solution.

Processes for migrating devices and platforms (if applicable).

Risks of the selected scenario.

3. Implementing and rolling out new devices, potential customizations and updated platforms. Finally, a migration plan is defined:

Governance model that will rule the migration process.

Migration plan.

Risk management plans.

Selecting and hiring vendors: devices, platforms, replacement/supply services, operations and maintenance services, potential RFP processes, etc.

Relationship models with the players involved.