Article

The global technology race towards 5G

Telecommunications providers throughout the world are preparing for 5G by implementing tests, auctions and agreements.

The global competition for the management, distribution and commercialization of 5G is proving to be particularly intense considering that the technology has not yet been standardized and it is still at an early development stage.

In this article, which forms part of the analysis series that explains in detail the fifth generation of mobile telecommunications, we will describe what the key market players are doing on a national and international level, along with forecasts from the most important entities in this scenario.

5G in Europe: a manifesto

In July 2016, the biggest telecommunications providers and manufacturers of devices and infrastructures presented a 5G manifesto to the European Commission. It was in response to a request made by the European Commissioner for Digital Economy and Society, Günther H. Oettinger, at the MWC that year, for the industry to contribute towards developing and driving the 5G Action Plan.

The document shared a number of key recommendations aimed at positioning Europe at the head of 5G on a worldwide level and developing the networks as of 2020. The authors presented all the potential benefits of 5G for the information society and explained how positive it would be from a user perspective. They described the main implications of 5G, particularly in terms of infrastructure investments (we should keep in mind that telecommunications providers recently made major investments in fixed fiber optic networks, mobile networks and 4G).

The signers asked the Commission to update, streamline and simplify the bureaucracy and rules that govern the industry, as well as to provide financial aid for the various deployments. They pointed out that telecommunications providers are constantly making infrastructure investments, but due to net neutrality (telecommunications providers cannot discriminate the content that travels along their networks or assign different speeds to each element), others ultimately benefit from their deployments, thereby creating uncertainty about the return on investment of 5G.

Another major point in the manifesto was spectrum: the authors agreed that there is not enough spectrum for everyone and that guaranteed availability is needed on a European level. The bands required for 5G range from 700 MHz (low band) to 32-38 GHz (high band). The manifesto also demanded the removal of restrictions that limit the use of existing licenses in order to perform pilot tests.

Telecommunications providers and vertical industries agreed to design a roadmap that includes performing trials and pilot tests for 5G, attaining network interoperability, developing use cases during the 2018-2020 period and sharing the results.

The plans of leading telecommunications providers in Spain

Spain’s 5G National Plan, presented in December 2017, was based on feedback from various players, telecommunications providers and vendors, and it includes the following measures centered around developing pilot experiences:

Providing temporary range authorizations for frequencies on different 5G bands, specifically the 34-38 GHz and 26 GHz bands to be used in pilot tests.

Holding one or more pilot project meetings for the experimental deployment of 5G networks aimed at validating new network capacities as well as developing applications and actual industry-related use cases.

Using these infrastructures to experiment with innovative third-party applications for smart fields, agriculture, tourism, connected cars, etc.

Tracking and sharing the pilot experiences along with the corresponding results via the National Plan’s Technical Office.

Implementing measures to support R&D&i in 5G technologies as part of the Strategic Action Economy and Digital Society.

Telecommunications providers in Spain have already taken a stance in this matter:

Through its “Ciudades Tecnológicas 5G” (5G Technology Cities), Telefónica is using several Spanish cities, particularly Segovia and Talavera de la Reina, to perform all types of 5G tests alongside Nokia and Ericsson.

In December 2017, Vodafone announced that Seville and Málaga would be the cities for its 5G pilot tests in the second half of 2018. In February of this year, Vodafone and Huawei completed the world’s first video call using the non-standalone 5G standard that was approved two months earlier.

Orange and Ericsson jointly reached average connection speeds of 15 Gbps in Madrid using 5G, with maximum ranges of 17 Gbps via the 28 GHz band that was granted to Ericsson by the government as an exception for these types of tests using a 300 kg terminal.

Towards the end of February 2018, MásMóvil announced that it was finalizing the purchase of 35 GHz frequencies in preparation for 5G.

What is the rest of the world doing?

In 2017, ten key tests were performed throughout the world and the forecasts for the upcoming years are as follows:

Europe: Pre-commercial launch of Everything Everywhere (EE) in 2019, with plans to launch the commercial service in 2020.

U.S.A.: Ericsson and Verizon have carried out pilot tests involving fixed wireless customers with the aim of launching the new-generation networks (NGN) in late 2019.

Japan: This country plans to provide 5G coverage in Tokyo for the 2020 Olympics.

China: China Telecom has planned field tests in six Chinese cities for 2019.

South Korea: Intel and KT unveiled a preview of 5G during the 2018 Winter Olympics with the aim of completing the commercial launch between 2019 and 2020.

Initial investments in 5G

Although the commercial tests have been planned for the coming years, the fact that the technology is not yet fully standardized means that telecommunications providers have not finalized their specific commercial deployment plans.

Just like the previous generation, 5G faces the debate on who should fund the initial investment: telecommunications providers or the users and potential consumers of the technology. A telecommunications provider will only invest in the network if the returns and demand are certain.

Application developers are not designing products that require a network that does not yet exist. Something similar occurred with the 4G investment in Europe, but with the introduction of terminals like the iPhone, U.S. telecommunications providers witnessed increased data consumption by users. This change created new business opportunities that European telecommunications providers also took note of when deciding to focus on that technology.

Roadmap

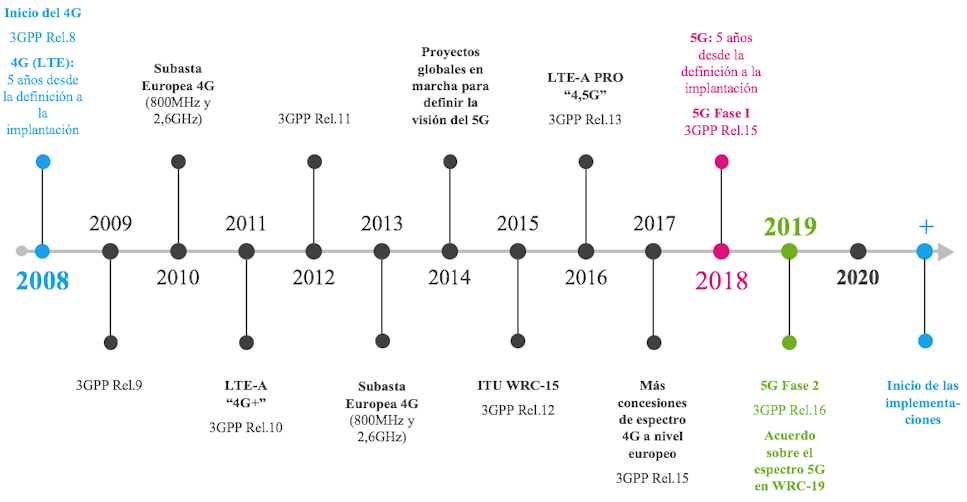

The 3rd Generation Partnership Project (3GPP) divided version (release) 15 of the standard into two parts: the first for December 2017, when 5G New Radio (NR) was approved for non-standalone; and the second scheduled for June 2018. The spectrum agreements and the conclusion of the existing pilot tests are expected for 2019, making it possible for the network’s European deployment to begin as of 2020 and the actual impact of 5G to be visible as of 2025.

The GSMA predicts that 5G commercial networks will begin to be deployed extensively at the start of the next decade, with coverage for a third of the global population by 2025.

A few years filled with intense tests and auctions for spectrums, agreements and standardizations around the world await. The question is, who will be at the forefront of 5G? Europe, Asia or the U.S., since progress is being made at virtually the same pace throughout the world. Regardless of who gets there first and whether the forecasts are correct, it is expected that by 2025 there will be widespread access to the technology that will open the doors of the Internet of Things.