Article

B2C and B2B sales: new opportunities for telecommunications providers

Harnessing the experience gained in every industry is the key to facing new challenges that arise throughout the sales process

When discussing markets, the difference between B2C and B2B is usually mentioned. Traditionally, telecommunications companies have operated and done business in a very similar manner in both segments through communication systems of varying complexity. However, the two segments have evolved and are becoming increasingly different.

Markets and clients

To understand the differences between selling to each of these segments, their basic features and client needs must be considered.

B2C is relatively homogeneous and simple to define. In other words, customers make purchases for personal use, and their needs are covered by standardized products.

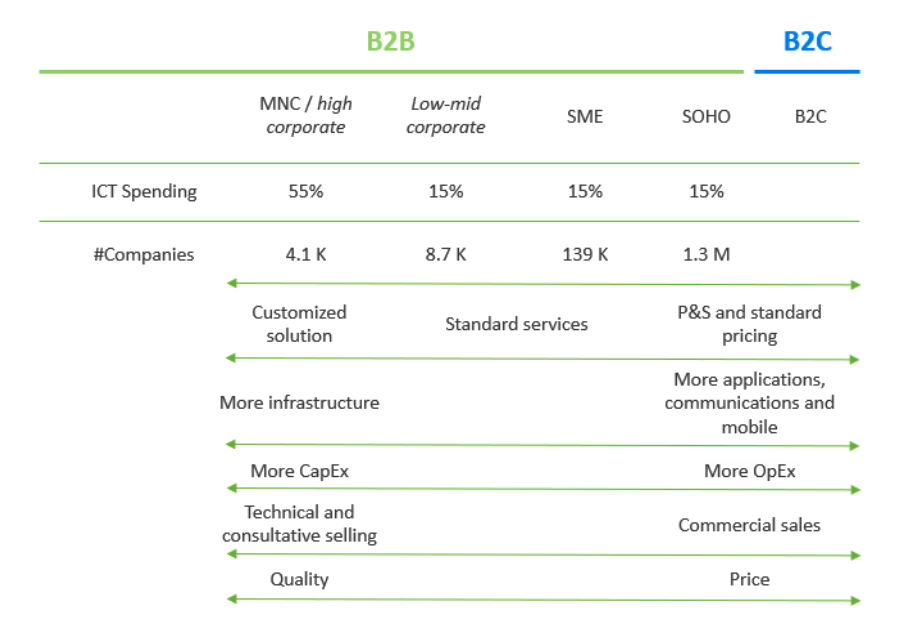

However, B2B is much more heterogeneous. On one end, we have self-employed people and small businesses that have similar needs as residential customers, but with additional products and services. At certain companies, these clients are handled by the Residential Business Unit due to the similarity in how those sales and channels are managed. On the other end, we have large corporations that have big ICT budgets (information and communications technology) and use the latest technologies.

This leads us to identify four main differences between these two markets:

Positioning: in B2C, overall, the positioning is increasingly driven by price, with certain exceptions such as television solutions featuring differentiated content. In B2B, on the other hand, assurance and quality play a bigger role because a bad decision or poor ICT services can have a disastrous impact on the client’s business.

Spending and profitability: in B2C, the average spending per customer is low and varies minimally from one product to another. This leads to a low ARPU (average revenue per user), but with fast and stable consolidation over time. In B2B, on the other hand, average spending varies significantly, depending on the client’s size and sales, and may be distributed among several vendors. There may also be a high initial investment in the form of equipment or design and implementation tasks.

Buyer: in B2C, the buyer is easily identifiable and can sometimes be classified into common archetypes. However, B2B buyers have more diverse profiles. At large corporations, the buying decision can be made by a group of people with various roles and from different departments (IT, management, finance, operations, procurement, etc.). This leads to the next difference.

Buying decision process: when B2C comes to mind, we think of a quick and simple purchase that is oftentimes automated. This process is completely the opposite for B2B in most instances. In general, it is a much more rational purchase than in B2C, and although the process is similar for small businesses, it is rarely automated. In companies of other sizes, these purchases take weeks (or even months, in the case of large companies) and entail several phases of analysis and bids. The concept of “consultative selling” is becoming increasingly widespread.

The table below summarizes this concept:

Upon explaining the characteristics and type of client for each one, we will focus on the challenges faced by the segments during the sales process and cover the products that clients demand, the market and the channels through which these products are sold.

The path toward telecommunications providers offering IT services for B2B

Why do telecommunications providers want to offer IT services?

B2B spending on communication and data is stagnant or decreasing, despite the rising performance. Traditional services for communication, data and cell phone service have become a commodity with minimal differentiation between telecommunications providers. Additionally, high-performance solutions have become democratized, and technologies like FTTH and productivity suites by Microsoft and Google have replaced expensive legacy solutions.

However, there is rising demand for IT services that leverage digitalizing operations and relationships with clients and vendors, which translates into annual market growth of 5-20%, depending on the technology. According to Gartner, “worldwide IT spending is projected to total $4.6 trillion in 2023, an increase of 5.1% from 2022.”

Technology has a fundamental impact on a company’s business and operations. However, this technology is becoming increasingly specialized, varied and sophisticated, and requires expertise beyond a company’s reach, which is why they are turning to a technological partner to support them through their digital evolution.

This role has traditionally been handled by integrators of varying sizes, depending on the company, from small IT shops to technological multinationals, as well as consulting firms, medium-sized integrators, tech manufacturers, etc. In recent years, telecommunications providers have entered this market and obtained revenue that, in certain instances, surpasses what they earn from traditional services.

A telecommunications provider’s biggest assets are its knowledge of digitalization and communication technologies, capillary sales network, and industrialization and standardization capabilities for creating economies of scale that would otherwise be difficult to obtain through other means. However, they are often viewed as communications service providers and therefore less suited for these types of services.

The diagram below shows the services that telecommunications providers usually offer to B2B clients:

What challenges do telecommunications providers face with these new IT services?

These services are unlike communications services and pose new challenges for telecommunications providers.

First, the sales force must evolve toward consultative selling that is much more technical. This requires understanding the industry and the client’s problems, which vary according to the company’s industry and size.

These services are also of a different financial category because they have a much greater OpEx component given the importance of the services being managed and the professionals, backed by an array of tools. It is therefore essential to control the direct and indirect costs, which in turn affect fundamental aspects like defining the price and creating efficiencies.

Lastly, these services require a high degree of agility in managing the operations, components and price in order to remain competitive in the market. Many are delivered by third parties, making it necessary to industrialize and standardize vendor controls and integrate their services into our operations.

The path toward customer knowledge in B2C

As mentioned earlier, B2C services differ only slightly, have a churn rate of 20-25% according to telecommunications providers, and compete greatly based on price. As a result, selling is a very industrialized and controlled process driven by dashboards and KPIs. This requires very intense and real-time data analysis, processing and management.

On the other hand, it is important to integrate the client’s knowledge to track sales opportunities and personalize the process. This knowledge is harnessed through MarTech technologies and solutions that enable collecting information about the client and acting accordingly. Historically, these technologies have been developed primarily on digital channels because they allow monitoring and logging more client parameters and interactions, as well as a higher degree of personalization and much closer tracking.

On the other hand, the B2C customer experience is increasingly influenced by GAFA (Google, Amazon, Facebook and Apple) expectations and the rising use of online channels. Clients expect to find all the necessary information, make their buying decision, activate the service and resolve any questions instantaneously. This creates multiple interactions that can be harnessed by telecommunications providers to offer services and content that may be of interest to them thanks to the knowledge obtained about the client.

However, the reality of telecommunications providers and B2C clients is multichannel. Although the online channel is gaining importance, telecommunications providers continue to have a higher sales volume via traditional channels such as phone sales, shops, distributors and door-to-door. Multiple channels are frequently used during the sales process, for example as information sources or to begin a sale that is then closed in another channel. This variety creates an additional challenge to detect the client's identity and follow up accordingly.

This identification aims to target the client with specific proposals, messages and services. This action can be personalized according to NBO/NBA logic, with increased granularity for more sophisticated models. It should be applied to all the channels and create a consistent experience that ensures the client receives the same information from any channel.

Learning and similarities

As we have seen, the B2B and B2C markets have major differences. However, important aspects can be learned from each other.

B2C → B2B

In B2B, customer knowledge can be used, with B2C lessons learned as a reference. It is based on improving automation and industrialization. This poses the following specific challenges:

Channels: multiple business interactions not logged or traced, customer expectation. There is a smaller presence of digital channels in B2B.

Client complexity: multiple roles involved in the purchase, departments.

Complexity of the supply: wide array of products and services for different needs, complexity in the supply’s configuration, personalized prices and discounts.

Management based on KPI and information: dashboard creation and availability, with the possibility of implementing measures and analyzing their immediate impact.

B2B → B2C

Similarly, B2C is starting to sell services beyond the telecommunications sector to customers, such as electricity, alarms, banking services, etc. This creates problems in multiple aspects that are much more common in the B2B segment:

Supply: configuring the supply, personalizing prices and discounts, or transparently integrating third-party services, among others.

Sales force and channels: specializing and training the sales force, incentivizing multi-service sales, directing the sales pitch on client needs, consultative selling, etc.

Sales management: greater focus on cross-selling, managing the client’s profitability and gross margin, etc.

We have covered some of the different challenges that B2C and B2B face in their sales and how to harness their experiences to solve new problems that arise in the two.

The next article will explain how to undertake these challenges by digitalizing the sales process through two different approaches: targeting the client using online channels and targeting internal operations using traditional channels.

Articles about Customer

We share knowledge